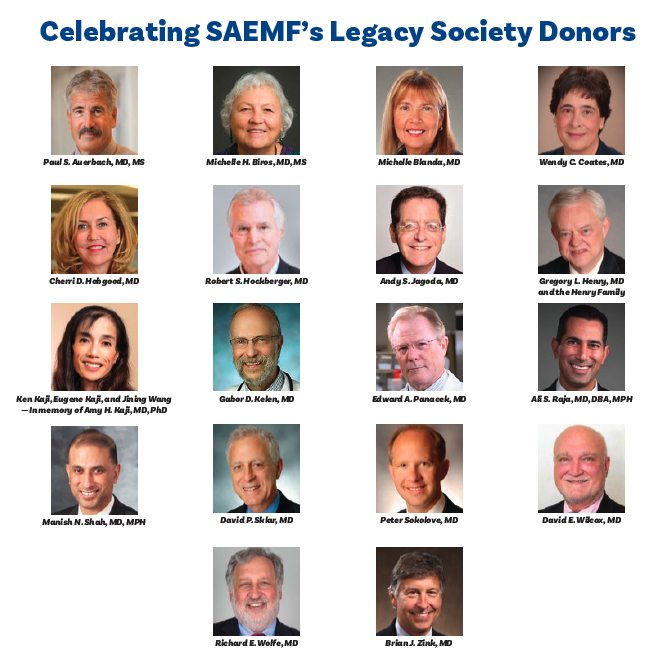

The Legacy Society

Leave a Lasting Legacy

A legacy gift to the SAEM Foundation is an opportunity to write a stirring epilogue to the story of your life. Remembering the SAEM Foundation in your planned giving is a profoundly meaningful way to leave a legacy that will benefit generations of

emergency medicine researchers beyond your lifetime. You will feel a deep sense of satisfaction knowing that your generosity and good works will live on to benefit the future of emergency medicine for years to come.

Become a Member of the SAEMF Legacy Society

The SAEMF Legacy Society is a cohort of leaders who have invested in the future of emergency medicine by donating a portion of their estate to the SAEMF. By including the SAEMF in your planned giving, you will help ensure the SAEMF has the resources to continue supporting new investigators long into the future.The Right Time to Make a Legacy Gift

Experts recommend you review your estate plan and will throughout your lifetime, but especially when these 12 life events occur (source Kiplinger). When you update your will is also a good time to consider adding the SAEMF as a beneficiary.

If you are prepared to make a Legacy Gift decision now, there are many options for your consideration. A simple bequest is often the easiest.

Bequest and / or Trust Language

I give, devise, and bequeath to The SAEM Foundation, a 501(c)(3) charitable organization having its principal offices in Des Plaines, Illinois: the sum of $_____ or _____ percent of my estate. [or all (or _____ percentage of) the rest, residue and remainder of my estate.]

This gift is to be used to further the charitable purposes of The SAEM Foundation, the philanthropic arm of the Society for Academic Emergency Medicine, at the discretion of the foundation's board of trustees.

The SAEM Foundation Taxpayer Identification Number is 26-2371803.

Here are a few other options to consider:

Goal | Gift Option | Method | Potential Benefit |

Make a gift that costs you nothing during your lifetime | Bequests - gifts through your will/trust | Include a gift of cash, property, or share of your estate in your will or trust – See the Bequest/Trust Language for your will in this document. | A gift that does not affect your cash flow today and that can be adjusted as circumstances change |

Make a gift while leaving more of your estate to your heirs | Designation gifts of retirement assets (e.g., 401-K, IRA) | Name us as the charitable beneficiary of your retirement plan and pass less taxed assets to your heirs. Check with your advisor about gifting a portion of your IRA during your life and receiving a charitable deduction. | Avoid income tax on assets; pass more of your estate to your heirs |

| Make a gift and receive a steady income for life | Charitable Remainder Trusts | With a charitable remainder trust, you or other named individuals, can receive income for life or a period not exceeding 20 years from assets you give to the trust you create. By designating the SAEM Foundation as a beneficiary, you are helping to secure the future of SAEM Foundation. | Diversify assets, avoid or defer capital gains, receive charitable deduction, secure future income |

| Make a large gift at little cost | Life Insurance | Name SAEM Foundation as beneficiary or transfer ownership of a policy you no longer need | Take a tax deduction for the cash value now; potential future deductions through gifts to pay policy premiums |

Already made a commitment?

Several longtime SAEM members have already included the SAEMF in their estate plans. If you are one of these thoughtful donors, please let us know by completing the SAEMF Legacy Society Declaration of Intent and returning it to foundation@saem.org so that we can recognize your generosity.

On behalf of the SAEMF Board of Trustees and SAEMF Legacy Gifts Committee, thank you for considering becoming a member of the SAEMF Legacy Society.

Individual Donor Legacy Society Recognition

The SAEMF Legacy Society recognizes individuals who have made a commitment to include SAEMF in their planned giving in SAEM and SAEMF communications, including online, in SAEM Pulse, at SAEM's Annual Meeting, and in SAEMF's Donor Guide.